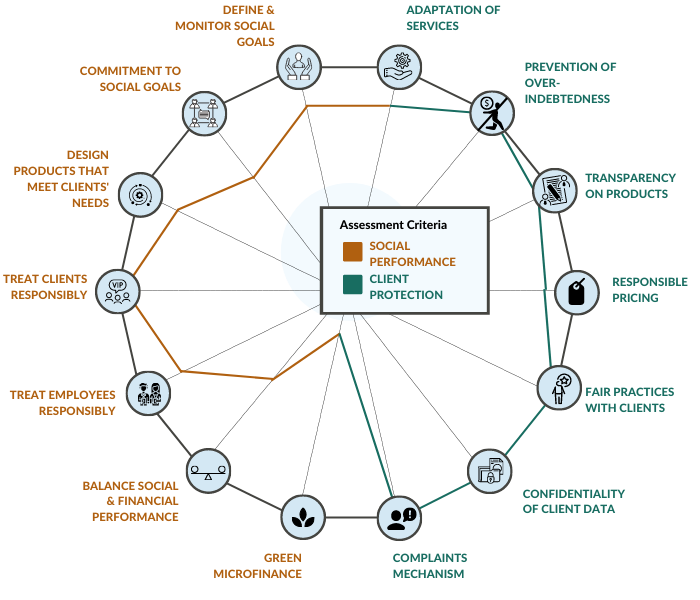

At DAI Asset Management (“DAI-AM”), our team screens portfolio investments for institution responsibility as rigorously as we do financial stability. Ensuring portfolio responsibility starts at deal origination and continues throughout the lifecycle of our investment. We believe that by putting our investments to work in institutions that are ethically responsible, offer fair and competitive rates, and operate in a manner that serves and protects customers, we are strengthening the financial impact of our capital, promoting transparency, and helping to diminish the footprint of problematic lenders. Our screens also help to exclude institutions that may correlate with higher environmental, social and governance (ESG) risks, any of which could undermine the value of the investment and impair impact performance. To help assess institution responsibility, DAI-AM utilizes ALINUS,1 a social data collection tool that measures the implementation of the Universal Standards for Social Performance Management across the following 14 metrics:

[1] ALINUS is a publicly available social data collection tool for due diligence monitoring, based on the SPI4, the social audit tool to measure implementation of the Universal Standards for Social Performance Management.https://cerise-spm.org/wp content/uploads/sites/3/2018/12/AlinusToolkit2017.pdf

The above radar illustration reflects actual results of an assessment of a DAI-AM portfolio company.