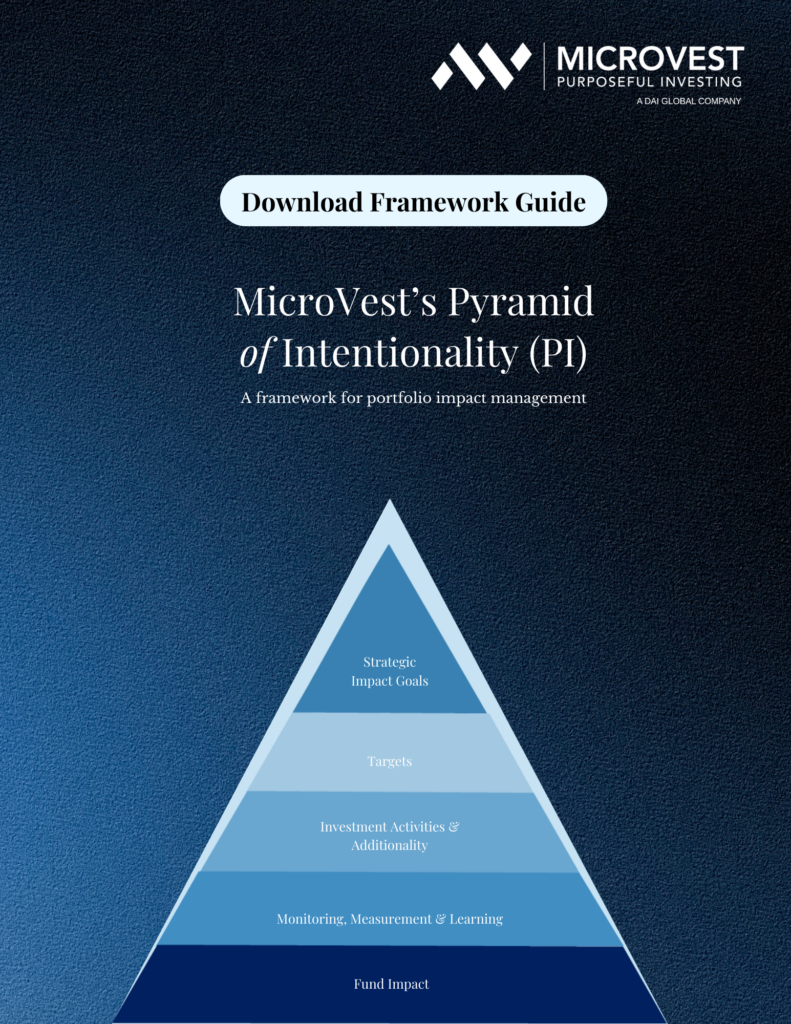

DAI Asset Management (“DAI-AM”), formerly, MicroVest, a pioneer of U.S.-based microfinance investing, today launched its new Impact Framework: The Pyramid of Intentionality (PI). The new Framework seeks to evolve the practice of impact management across the asset manager’s existing and future funds, with a standardized approach to assessing, managing, and measuring the impact targeted by the firm’s investments, in line with leading industry standards. To accompany the launch, DAI-AM has published a Framework Guide to illustrate how the PI was designed and developed.

“We have evolved our portfolio impact management processes so that we can better assess our impact performance against the portfolio’s targeted sustainability goals—not just at the firm level, but across our investments and their ultimate beneficiaries,” said Leela Vosko, DAI-AM’s Director of Impact. “Our new Framework is aimed at enhancing our efficiency and effectiveness in managing, measuring, and reporting on that impact.”

The launch of the PI coincides with the firm’s 20th anniversary and marks three years since its acquisition by global development company DAI. Today, DAI-AM forms part of the asset management division of DAI Capital, the investment and advisory arm of DAI, which operates across three verticals: asset management, investment advisory, and project finance.

“Over the coming decade, DAI-AM, with our parent company DAI Capital, aims to mobilize substantial private capital to address key development challenges at scale,” said DAI-AM Chief Executive Officer Michael Apel. “This Framework lays the groundwork for unifying and standardizing impact evaluations to facilitate more efficient and impactful capital deployment.”

DISCLOSURE INFORMATION

The information contained here has been provided by DAI Asset Management, LLC (“DAI-AM”) and no representation or warranty, expressed or implied is made by DAI-AM as to the accuracy or completeness of the information contained herein. Specific portfolio or pipeline companies discussed are for educational purposes only and do not represent all of the portfolio holdings and it should not be assumed that investments in the portfolio or pipeline company identified and discussed were or will be profitable. The companies profiled were selected based on their unique uses of technology in the context of social impact, with no reference to amount of profits or losses, realized or unrealized. This document is for informational purposes only and is neither an offer to sell nor a solicitation of an offer to purchase an interest in any DAI-AM product (the “Funds”), and nothing herein should be construed as such. Any such offer or solicitation will be made only by means of delivery of a definitive private offering memorandum which contains a description of the significant risks involved in such an investment. Prospective investors should request a copy of the relevant Memorandum and review all offering materials carefully prior to making an investment. Any investment in a DAI-AM product is speculative, involves a high degree of risk and is illiquid. An investor could lose all, a significant portion or some amount of its investment. You should not construe the contents of the enclosed materials as legal, tax, investment or other advice. To invest with DAI-AM, one must be a qualified purchaser and an accredited investor. The investments may be deemed to be highly speculative investments and are not intended as a complete investment program. They are designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment in the Funds and who have a limited need for liquidity in their investment. There can be no assurance that the Funds will achieve their investment objectives.